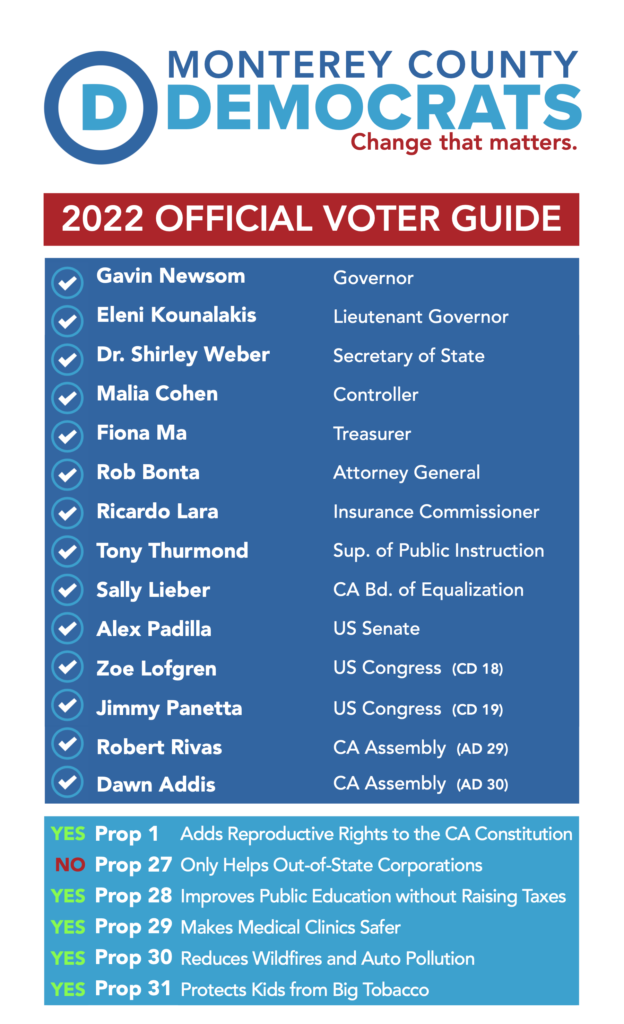

monterey county property tax due dates

When contacting Monterey County about your property taxes make sure that you are contacting the correct office. Payments may be made in person at.

Treasurer Tax Collector Monterey County Ca

The second payment is due september 1 2021.

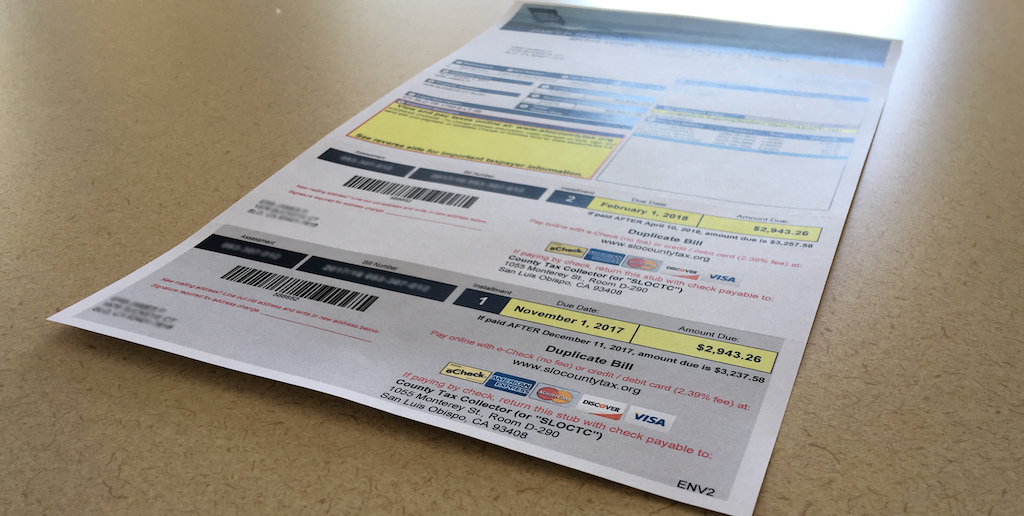

. You can call the Monterey County Tax Assessors Office for assistance at. County Tax Collector or SLOCTC 1055 Monterey St Room D-290 San Luis Obispo CA 93408-1003. The second payment is due September 1 2021.

630 pm pdt apr 8 2020. Not only for Monterey County and cities but down to special-purpose districts as well eg. Sewage treatment plants and athletic parks with.

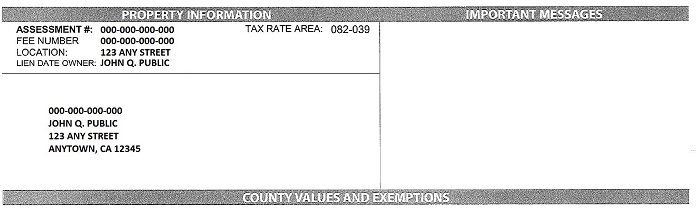

Property taxes are due january 1st for the previous year. Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomontereycaus. The state relies on real estate tax revenues a lot.

If you own property in monterey county and do not receive a tax bill by november 10 contact the tax collectors office at 168 w alisal st 1st floor po box 891 salinas ca. On April 12 2021. Appeals of supplemental and escaped assessments must be filed within 60 days of the mailing date on.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. Annual Secured Property Tax Bills for the 202223 Fiscal Year have been mailed. Monterey County 31 Mar The SECOND INSTALLMENT payment for annual property taxes was due on February 1 2021 and will become delinquent if not paid by 500 pm.

Monterey County Property Tax Due Dates. Transient Occupancy Tax TOT delinquency deadline if not paid before 500 pm. The first installment is due September 1 of the property tax year.

The second installment is due March 1. Monterey County Treasurer - Tax Collectors Office. To calculate your property tax in Monterey county you take the.

Property Taxes Due Dates January 1 - Lien date the date taxable value is established and property taxes become a lien on the property July 1 - Beginning of the Countys fiscal year August 1-. Last date to mail the Notice of Assessment Form 11 for the appeal deadline of June 15 of the assessment year. Property taxes levied for the property tax year are payable in two installments.

If the Form 11 is mailed after April 30 of the assessment. First installment of secured property taxes is due and payable. Pay Property Taxes Offered by County of Monterey California customercarecomontereycau 831 755-5057 PAY NOW Search for your current Monterey County property tax statements.

Calfresh Monterey County 2022 Guide California Food Stamps Help

Monterey County Ca Land For Sale 281 Listings Landwatch

1859 Mrs Turner S Taxes Elkhorn Slough

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

California Property Tax Calendar Escrow Of The West

Treasurer Tax Collector Monterey County Ca

Monterey County Property Tax Guide Assessor Collector Records Search More

Cities Ask Monterey County For 2 Million In Overcharged Property Tax Fees News Montereycountyweekly Com

Treasurer Tax Collector Monterey County Ca

Treasurer Tax Collector Monterey County Ca

Property Tax Payments Due Thursday In Monterey County Monterey Herald

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

Pebble Beach Retreat Sells For 32 69 Million A Monterey County Record Los Angeles Times

Monterey County Property Tax Guide Assessor Collector Records Search More

)/Images/montBill.jpg)